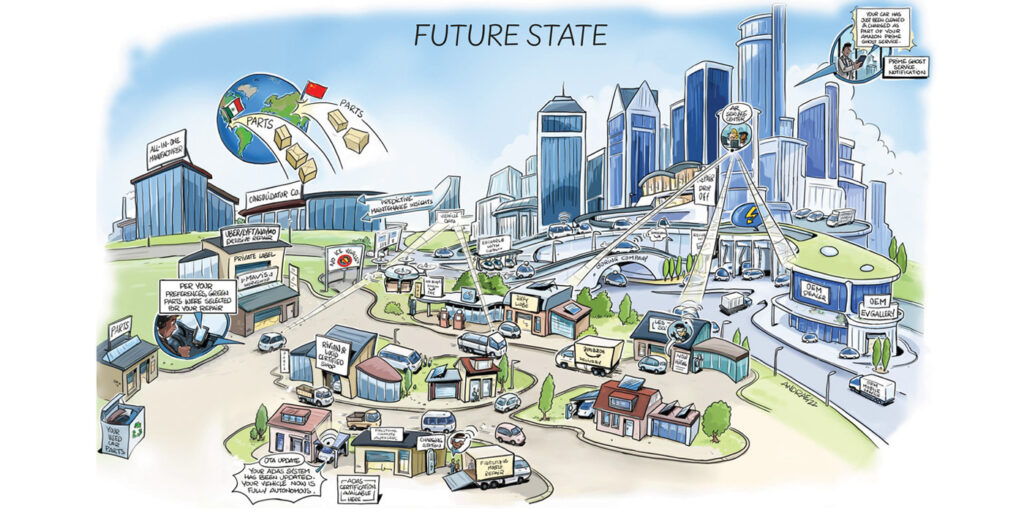

Electric vehicles. E-commerce. Vehicle complexity. Consolidation. Autonomous Driving. Connectivity. How will these and other trends affect the automotive aftermarket over the next decade, and more importantly, how should aftermarket suppliers respond?

A new study – “The U.S. Automotive Aftermarket in 2035” – attempts to answer these questions, with aftermarket suppliers “facing more inflection points than we ever have before,” in the words of Automotive Aftermarket Suppliers Association (AASA) President and CEO Paul McCarthy.

“And the reality is we can’t handle them all,” McCarthy said at the 2022 AASA Vision Conference in Dearborn, Michigan. “So we need to understand which ones are really going to disrupt us and which ones may matter less. Because if there’s one thing we know, the aftermarket in 2035 is not going to look like the aftermarket today.”

Conducted by the management consulting firm Roland Berger, the study looks at the current and future states of the automotive aftermarket. One of the most alarming conclusions from the study is that aftermarket suppliers aren’t ready to deal with nine high-impact trends: BEV (battery-electric-vehicle) penetration; e-commerce and o2o (online-to-offline); consolidation; labor shortages; supply chain disruption; data access; autonomous driving; supply chain footprint; and sustainability.

Barry Neal, senior partner at Roland Berger, and Neury Freitas, principal at Roland Berger, presented an overview of the study findings at the AASA Vision Conference. Here are some of the highlights.

Battery Electric Vehicles

How much and how soon will BEVs affect the independent aftermarket? That all depends on which part of the market you serve.

By 2035, the study projects that only 2% of 12-year-old vehicles and older will be electric, while 11% of 8- to 11-year-old vehicles will be electric. However, the impact of BEVs will be more pronounced in newer vehicles, with 32% of 0- to 3-year-old vehicles expected to be electric.

“The more dependent you are on the OES or OEM channel, the more or sooner EVs will actually impact your business,” Freitas explained.

At 100,000 miles, BEVs require 50% fewer service visits than internal-combustion vehicles, based on OEM service recommendations. By 200,000 miles, that gaps shrinks slightly to 47%.

“There clearly are services that will disappear in an EV,” Freitas said. “Anything that’s related to the engine, anything that’s related to combustion will go away.”

BEVs will need battery coolant, but due to regenerative braking, brake systems typically last longer on electric vehicles.

“The tire players are really happy,” Freitas added. “They are waiting for EVs, because either you have a heavier vehicle that needs a stronger structure of the tire – therefore they’re more expensive – or if you use a normal tire, that’s going to wear faster. So, that’s a positive.”

Online-to-Offline Business Model

The pandemic has accelerated the growth of o2o in the automotive aftermarket, as more consumers embraced buying parts and booking appointments via their mobile devices. The linkage between the offline and online worlds “brings a lot of benefits and a lot of convenience for consumers,” Freitas asserted.

The increased convenience for consumers, and the cost savings along the value chain, will continue to drive the growth of o2o in two phases: parts efficiency, as proactive diagnostics and digital parts/service selection and scheduling enable a lower cost structure; and labor efficiency, as advanced booking/scheduling and predictive maintenance improve labor utilization and throughput.

“If you get the higher convenience for consumers, together with the potential cost savings, at a first step, if you know which parts will be needed and where they’ll be needed before they are actually needed, you can cut a few steps [from] the value chain and in the supply chain, and you can actually save some real money, as you don’t need hot-shot [delivery], for example,” Freitas explained. “And then in a second step, once we get to a large enough critical mass, and the shops are able to schedule similar services back to back, we might get some efficiencies from the technicians as well.”

Consolidation

According to Roland Berger, the United States is leading the way in terms of consolidation, with the top 10 distributors in the U.S. independent automotive aftermarket (IAM) commanding 75% to 80% of the total market share. Europe is a distant second, at 30% to 35%, while China is at 5% to 10%.

Roland Berger sees more consolidation ahead for parts suppliers and service providers (mechanical and collision). Going forward, there won’t be as many opportunities for large retailers to acquire distributors, Freitas asserted.

“Therefore, if one of those big companies has a hiccup over the next 12, 13 years, we see as a chance of two of those top four or five players actually merging and becoming an even larger player,” Freitas added.

Labor Availability

Looking at the big picture, U.S. unemployment rates were at historic lows in the years leading up to the COVID-19 pandemic. When the pandemic escalated in early 2020, it skyrocketed. Since then, the unemployment rate has been declining steadily. According to the U.S. Bureau of Labor Statistics, the unemployment rate in March dropped to 3.6%.

Neal and Freitas showed two charts that don’t bode well for the future of the IAM. One chart showed a steady decline in the number of students completing postsecondary degrees for automotive repair since 2010. The other chart showed the imbalance between the supply and demand of technicians since 2010. While the technician shortage is nothing new, the gap between supply and demand is projected to widen in 2025 and beyond.

Freitas concluded: “If the industry does not really get organized, we don’t think this problem is going to get solved anytime soon.”

Supply Chain

The headline here is that China appears to be losing its cost advantage – even without tariffs.

For the past decade or so, if you wanted to manufacture products on the cheap, China was the obvious destination. However, when you factor in the rising costs of outbound freight, raw materials, manual labor and other variables, China will lose its cost advantage to Mexico as soon as this year. By 2035, due to the projected increase in China’s labor costs, it will be significantly cheaper to manufacture goods in Mexico compared to China, according to Roland Berger.

Not surprisingly, Roland Berger projects that the percentage of U.S. auto parts manufactured in Mexico will grow from 24% in 2020 to 31% in 2035.

Data Access

By 2035, nearly 100% of new vehicles sold in the United States will be connected, meaning they’ll have the capability to receive and transmit information. Extrapolated to the total U.S. vehicle parc, 66% of vehicles will be connected.

How we get to that point – and how it will affect the IAM – is less certain. Currently, the automakers control most of the data generated by vehicles, which is bad for consumers, bad for IAM suppliers and good for the OEMs. In the medium term, Roland Berger anticipates a shift to open APIs (application programming interfaces) and “mixed control” of vehicle data.

In the long term, a move toward open APIs and open data would be best for IAM suppliers. However, where we land will likely be determined by federal lawmakers and the OEMs.

Action Steps

In light of the study’s findings, Neal and Freitas outlined a number of potential steps that IAM suppliers could take.

“In terms of individual responsibilities, there’s the importance of reviewing the portfolio and product strategy,” Neal said. “As you look at the influx of new technologies, both in terms of electronics, battery electric vehicles, ADAS and autonomous, how are you adjusting your portfolio to adapt to those and what is the strategy you have, whether that be a last-man-standing strategy or looking for a third leg in terms of other opportunities, or the development of an EV strategy to attack some of the new opportunities that are coming out?”

Regarding the technician shortage, Neal also emphasized the importance of supporting trade schools “as well as supporting of advocacy at the high school and the middle school level for robotics programs and mechanical programs to ensure the interest of that technician force of the future, as well as an industry-level support for new entrants and opportunities, supporting aspects such as augmented reality and remote support for technicians in the field to allow some of those newer solutions to support a broader labor force in the future in terms of the capability set in technology.”