Advance Auto Parts reported second-quarter sales of $2.6 billion, a 6% year-over-year increase.

Comparable-store sales jumped 5.8%, buoyed by a rebound in DIFM business, which took a hit in the early stages of the pandemic in second-quarter 2020.

Overall, Advance saw year-over-year double-digit growth in its DIFM business, “and a slight decline” in its DIY sales, CEO Tom Greco noted during the company’s Aug. 24 conference call.

Neither result was a surprise. DIY sales surged in Q2 2020, as stay-at-home orders and stimulus checks triggered “abrupt shifts in consumer behavior across our industry,” as Greco put it. Fast-forward a year, and Advance and other publicly traded parts retailers are up against some tough year-over-year comparisons in the DIY segment.

Those same factors put a dent in DIFM sales during the early stages of the pandemic. But that segment has been clawing back, and Greco said Advance “began to see improving demand late in Q1 2021, which continued into Q2.”

Macroeconomic factors such as the gradual recovery in miles driven, and an uptick in used-car sales, have been powering the DIFM rebound.

At Advance, Greco asserted that its “strategic investments are strengthening our professional-customer value proposition.”

“Within our Advance Pro catalog, we saw improved key performance indicators across the board, including more online traffic, increased assortment and conversion rates, and ultimately growth in transaction counts and average ticket,” Greco said.

As he has in recent conference calls, Greco also highlighted he company’s dynamic-assortment machine-learning platform, which aims to improve parts availability in local markets. Investments in technical training for installers are paying off, he added, and the company continues to grow membership in its TechNet program for independently owned repair shops.

“Each of these pro-focused initiatives has been a differentiator for Advance, enabling us to increase first-call status with both national strategic accounts and local independent shops,” Greco asserted.

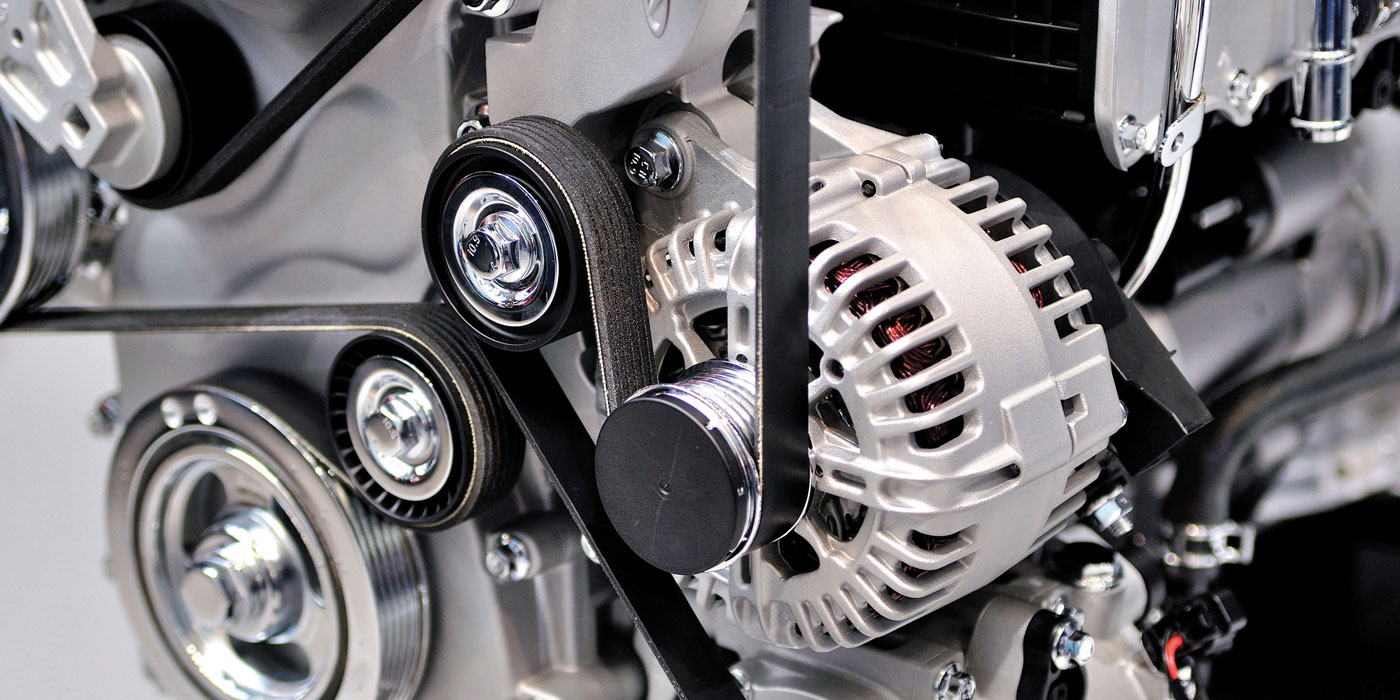

On a category basis, brakes, motor oil and filters were hot sellers in the second quarter, “with continued momentum in key hard-part professional categories,” according to Greco.

“Regionally, the West led our growth, benefiting from an unusually hot summer, followed by the Southwest, Northeast and Florida,” Greco added.