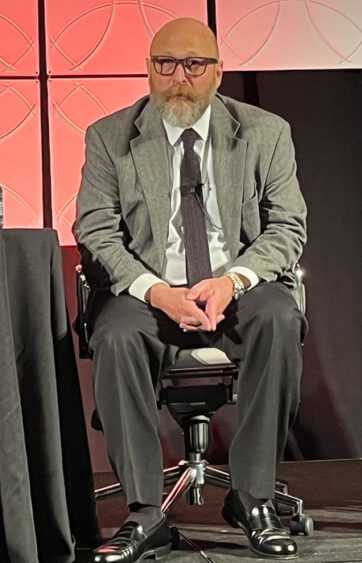

Photo caption, left to right: Ben Brucato, vice president of membership and engagement for MEMA Aftermarket Suppliers; Gino Amador, president of Snap-on Equipment at Snap-on Inc.; John Lerner, chief commercial officer for GOJO Industries; and Cal Ganda, head of Americas Automotive Aftermarket for the ContiTech Power Transmission Group

Managing complexity and uncertainty is a fundamental challenge for business leaders. In recent years, though, it seems like the world has been serving up a steady diet of curveballs – and not much else.

The pandemic, tariffs, supply chain disruptions, runaway inflation and the rise of e-commerce are just some of the issues that have tested the mettle of manufacturing executives over the past decade.

MEMA Aftermarket Suppliers’ 2023 Vision Conference in Rosemont, Illinois, was an ideal setting to get some perspective on the challenges and opportunities facing suppliers in today’s automotive aftermarket. For the second year in a row at Vision, MEMA convened “Supplier Pain Points: A CEO Panel,” and the panelists riffed on topics ranging from remote work to vehicle electrification. Ben Brucato, vice president of membership and engagement for MEMA Aftermarket Suppliers, moderated the panel.

If anyone in the audience was tempted to steal a glance at their smartphone, Gino Amador, president of Snap-on Equipment at Snap-on Inc., made sure they were paying attention from the get-go.

“Half of you are probably going to go out of business,” Amador declared in his opening remarks. (He noted that his comments reflected his own opinions – not those of Snap-on.) “Let me say that differently: If you consider the trichotomy of climate-change advocacy, road-safety initiatives and a trade policy that is at best questionable, for most of you in this room, if you don’t reinvent yourselves, you’re going to have some trouble. And I’m not sure exactly how long you have to reinvent yourself.”

As dire as that sounds, Amador added that “the event horizon for being deep into change is somewhere in the neighborhood of 20 to 30 years.”

“What are you all so worried about?” Amador said. “This is not NADA. We’re not projecting what may or may not happen this year or next year or the year after that. That’s sort of baked in already. We know how many cars got sold three and four years ago. We know how many cars are coming off warranty. We know how many cars are in that perfect space of four to 11 years [old]. That’s the spot we need to be in. That’s where we make money.”

Then, Amador rattled off the projections for the number of vehicles in the four-to-11-year-old aftermarket sweet spot over the next several years, noting that “10 million more cars have entered the four-to-11-year space in the last two years.”

“I’m a third-generation executive in this industry. Never before have we seen 10 million cars enter the four-to-11 space. Coffee break? We should be having a champagne break.”

‘Unlimited Demand’

Demand forecasting has emerged as one of suppliers’ biggest pain points, especially in the wake of the COVID-19 pandemic. GOJO Industries, the maker of Purell hand sanitizer, is no stranger to demand spikes stemming from “unseen disruption,” as John Lerner, the company’s chief commercial officer, explained. Still, looking back at disruptive events such as the SARS outbreak, the Ebola virus disease and the H1N1 pandemic, they all paled in comparison to COVID-19.

“What was saw was effectively unlimited demand,” Lerner said. “In fact, we wiped our order book clean and went into hard allocation during that period, because we needed to provide transparency to our customers on what they would get and when.”

A logical response to unprecedented (yet unpredictable) demand is to invest in automation and other manufacturing technologies that can help boost production capacity and bolster operational efficiency and flexibility. That’s exactly what Akron-based GOJO did. However, the company learned that even if it achieved “unlimited production capacity,” it wouldn’t be able to meet demand without the critical components and raw materials needed to manufacture its products.

“Sanitizer is 70% ethanol,” Lerner explained. “We consumed an entire year’s worth of [ethanol] in three months and could not source it on the market for a very short period of time – which was terrifying.”

That was a wakeup call for GOJO, and company leaders saw a clear need to achieve “supply security” through vertical integration, as Lerner put it. In response to the pandemic, GOJO invested more than $400 million in capacity expansion and vertical integration, more than doubling the company’s manufacturing and distribution footprint.

GOJO has added the capability for in-house manufacturing of bottles and pumps, and now has “a captive supply of quite a bit of the critical materials that we use in our products,” according to Lerner. The company also has invested in “captive high-quality ethanol production” to reduce lead times and ensure supply of this critical material.

Continental is responding to the transformation of the automotive industry by consolidating ContiTech’s automotive activities, as part of a larger realignment of the ContiTech division. Panelist Cal Ganda, head of Americas Automotive Aftermarket for the ContiTech Power Transmission Group, applauded the strategic realignment.

“Within ContiTech today, we have multiple product-driven business areas … all reporting to Hanover [Germany], our global HQ,” Ganda explained. “This setup may have worked at some point in time. But if you take a look at what our customers’ needs are today, in an effort to have a customer-centric organization, we are rearranging ourselves to have an organization in the market for the market.”

In a February press release, Continental said the focus of the realignment will be on “increasing speed and efficiency, for example by accelerating decision-making processes, streamlining central functions and reducing hierarchical levels.”

“In the future, we’ll have one organization servicing the same customers, and I truly believe this is a significant game-changer,” Ganda said at Vision. “ … More importantly for me, any decisions on how we run the business [will be] made as close to the business as possible.”

Remote Work

Later in the panel discussion, Brucato asked the panelists to offer their thoughts on a topic that’s been the source of much debate since 2020: remote work. While many white-collar employees have embraced remote work in the wake of the pandemic, high-profile executives such as JPMorgan Chase CEO Jamie Dimon have pushed back on the trend, asserting that remote work is detrimental to collaboration and company culture.

Emphasizing that “human-to-human interaction is critical to success,” Ganda said ContiTech is striving to strike “the right balance” on working digitally, as he talked about the company’s hybrid approach.

“For example, we have identified certain events that we believe should bring people together. And for those [events], we highly encourage teammates and leaders for those teams to arrange such events onsite with their own teams,” Ganda explained.

Ganda talked about an approach in which one day is an “in-office day” for the entire organization, and an additional day is open for each team to “self-arrange.”

“People enjoy doing that,” Ganda added. “But it’s clear that it’s always a balancing act, and probably will be one to keep watching as we move forward.”

Amador offered a much different take on the topic.

“I’ll be unusually laconic,” Amador quipped. “Business is a team sport.”

Amador, however, didn’t bite his tongue when articulating his thoughts on the shortage of technicians and other skilled workers – a nagging pain point for the aftermarket and other blue-collar industries.

“We’ve been telling our children that the university was the path for some sort of life that had worth,” Amador lamented. “I don’t actually understand that. At 9:15 on a Thursday night [when something goes wrong], not a one of you has ever wished desperately that you could get a political scientist or historian on the phone.”

Until we can change the perception that the only path to success is by way of a four-year degree and an office job, the skills gap will continue to widen.

“If the people in this room do not champion the worth of the makers and the fixer – the people who actually keep the economy going – we are going to be in trouble,” Amador asserted. “Getting people to want to turn a wrench, getting people to want to be technicians – that’s my pain point.”