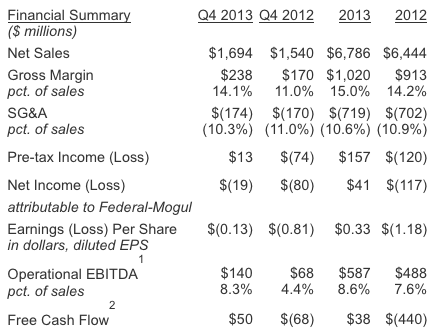

Fourth-quarter 2013 sales of $1.7 billion, up $154 million or 10% higher than Q4 2012; FY 2013 sales of $6.8 billion, up $342 million or 5% higher than FY 2012. • Operational EBITDA of $140 million in Q4 2013, up $72 million or 106% versus Q4 2012; FY 2013 Operational EBITDA of $587 million, up $99 million or 20% versus FY 2012. • Q4 2013 pre-tax income of $13 million up $87 million versus loss of $(74) million in Q4 2012; FY 2013 pre-tax income of $157 million up $277 million versus loss of $(120) million in FY 2012. • Q4 2013 free cash flow of $50 million; ending cash position of $761 million.

SOUTHFIELD, Mich. — Federal-Mogul Corp. (FDML) today announced fourth quarter 2013 sales of $1.7 billion, ten percent higher than the fourth quarter of 2012 with negligible foreign exchange impact. Pre-tax income from continuing operations was $13 million in Q4 2013, an improvement of $87 million versus Q4 2012. The company had a net loss of $(19) million in Q4 2013, an improvement of $61 million compared to Q4 2012. Operational EBITDA in Q4 2013, at $140 million or 8.3 percent of sales, was significantly higher than $68 million or 4.4 percent of sales in Q4 2012. The company’s improved performance in Q4 was driven by strong conversion on higher sales and substantially improved operating performance. The strong operating performance accompanied by improved working capital management resulted in a free cash flow generation of $50 million in the fourth quarter of 2013 compared with a cash usage of $68 million in Q4 2012. The net loss for the quarter was primarily attributable to restructuring and impairment charges of $25 million and a tax valuation allowance of $15 million recorded in the quarter. In addition to scheduled principal payments, the company also prepaid $250 million of debt during the quarter and had a cash balance of $761 million at December 31, 2013 in addition to an undrawn revolver of $550 million. Full Year 2013 For full year 2013, the company reported sales growth of five percent to $6,786 million, with negligible exchange impact versus 2012. The sales growth for the year was three percent excluding the impact of sales from the BorgWarner spark plug acquisition and European distribution agreement for ignition products. On a regional basis, total sales in North America and in Europe were each two percent higher, and in ROW six percent higher, on a constant dollar basis, excluding sales from these transactions. Federal-Mogul for 2013 reported net income of $41 million, compared to a net loss of $(117) million for 2012, a year-over-year improvement of $158 million or 2.4 percentage points of sales. This was primarily driven by improved operating performance for the year as well as higher sales from stronger vehicle production volumes. Operational EBITDA in 2013, at $587 million or 8.6 percent of sales, was $99 million better than operational EBITDA of $488 million or 7.6 percent of sales for the full year 2012. The company reported free cash flow of $38 million for 2013 versus a cash usage of $(440) million in 2012. “Federal-Mogul`s results for the fourth quarter and for full year 2013 are a reflection of improved operating performance, strengthening global markets and market share gains, particularly in the Powertrain segment,” said Rainer Jueckstock, Federal-Mogul co-CEO and CEO, Powertrain Segment. “We are continuing to make steady progress in growing sales, driving operating efficiencies and delivering high quality products to our customers.” Segment Results Powertrain Segment (PT) On a global basis, PT continued to gain market share in all regions and had revenue of $1,034 million in Q4 2013, up from $929 million in Q4 2012, a ten percent increase, on a constant dollar basis. During the same comparison period, both global light vehicle production and commercial vehicle production increased four percent. The PT sales increase is attributed primarily to a 17 percent sales increase in North America as compared to North American market growth of six percent in light vehicle production and 11 percent in commercial vehicle production. Sales in Europe grew by seven percent during the quarter, due in part to stabilization of the European market, higher volumes on new engine programs and growth in PT market share. During the same period, light vehicle production in the European market was essentially flat. PT sales in ROW grew by 19 percent, driven by strong growth in China. PT revenue growth in all regions increased at a higher rate than the underlying market production growth rates. “Increasing demand for Federal-Mogul products used in European light vehicle production drove improved sales in the fourth quarter,” said Jueckstock. “At the same time, we experienced continued OE sales growth in North America and Asia, especially China, versus Q4 2012. More than 35 percent of Powertrain`s sales growth during the quarter is attributable to new customer contracts. Our Q4 earnings performance continues to show that we are making good progress on restructuring in Western Europe and in the U.S., increasing operational efficiency and implementing ongoing cost reductions as we drive for growth and enhanced margins.” PT recorded operational EBITDA of $92 million in Q4 2013, an increase of $61 million versus Q4 2012, primarily driven by conversion on higher sales volumes and improved productivity. Operational EBITDA as a percent of sales increased to 8.9 percent in Q4 2013 from 3.3 percent in Q4 2012 as PT benefited from higher sales, ongoing restructuring actions and greater operational efficiency. For the full year 2013, PT had a six percent increase in revenue on a constant dollar basis to $4,173 million, up $247 million from $3,926 million in 2012. When excluding the impact of the BorgWarner spark plug acquisition, revenue was up five percent. During the same comparison period, global light vehicle production increased three percent and commercial vehicle production increased by four percent. PT sales grew in all regions reflecting higher OE demand and market share gains. For the full year, PT reported operational EBITDA of $378 million, a $90 million improvement versus $288 million reported in 2012. Operational EBITDA as a percent of sales increased to 9.1 percent in 2013 from 7.3 percent in 2012. Vehicle Components Segment (VCS) VCS in Q4 2013 had revenue of $727 million, up from $685 million in Q4 2012, an increase of five percent on a constant dollar basis. Revenue in Europe was up 17 percent, primarily due to increased sales from the ignition product distribution agreement. North American sales were up one percent. VCS revenue for the quarter was impacted by a reduction in original equipment sales as well as a decline in the export business, mainly due to the current economic situation in Venezuela. VCS recorded operational EBITDA of $48 million or 6.6 percent of sales in Q4 2013, an increase of $11 million versus Q4 2012. The improvement in operational EBITDA was driven by higher sales and operational improvements, partially offset by project costs. For the full year 2013, VCS sales increased by three percent to $2,935 million, up $82 million from $2,853 million in 2012, driven by increased sales to the European aftermarket. Excluding the ignition product distribution agreement, sales in Europe grew by four percent for the year, which was offset by sales declines in North America and ROW. For the full year, VCS reported operational EBITDA of $209 million, a $9 million improvement versus $200 million reported in 2012. “The financial results of the aftermarket business have stabilized, but I am not satisfied with our overall performance,” said Daniel Ninivaggi, recently appointed Federal-Mogul co-CEO and CEO, VCS. “We see further opportunity through aggressively investing in our product portfolio, improving our distribution infrastructure and pursuing growth initiatives, including our recent acquisition agreements for the Honeywell friction and Affinia chassis businesses, which will further enable us to better meet the needs of our customers.” About Federal-Mogul Federal-Mogul Corporation (FDML) is a leading global supplier of products and services to the world’s manufacturers and servicers of vehicles and equipment in the automotive, light, medium and heavy-duty commercial, marine, rail, aerospace, power generation and industrial markets. The company`s products and services enable improved fuel economy, reduced emissions and enhanced vehicle safety. Federal-Mogul operates two independent business segments, each with a chief executive officer reporting to Federal-Mogul`s Board of Directors. Federal-Mogul`s Powertrain segment designs and manufactures original equipment powertrain components and systems protection products for automotive, heavy-duty, industrial and transport applications. Federal-Mogul`s Vehicle Components segment sells and distributes a broad portfolio of products through more than 20 of the world`s most recognized brands in the global vehicle aftermarket, while also serving original equipment vehicle manufacturers with products including braking, chassis, wipers and other vehicle components. The company’s aftermarket brands include ANCO® wiper blades; Champion® spark plugs, wipers and filters; AE®, Fel-Pro®, FP Diesel®, Goetze®, Glyco®, Nüral®, Payen® and Sealed Power® engine products; MOOG® steering and suspension parts; and Ferodo® and Wagner® brake products. Federal-Mogul was founded in Detroit in 1899. The company employs 44,300 people in 32 countries, and its worldwide headquarters is in Southfield, Michigan, United States. For more information, please visithttp://www.federalmogul.com/.