After several years of mega mergers among the nation’s largest store owners, 2007 proved to be an anomaly: Among the 20 largest store chains in the U.S, not a single one was acquired.

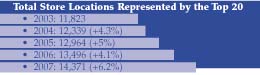

That’s not to insinuate that acquisitions didn’t occur; in fact, 2006 posted the greatest overall store count growth for the top 20 store chains in the last five years. As a group, total store counts grew by more than six percent.

Of other significance: four store groups changed rankings: O’Reilly Auto Parts now operates more stores than General Parts Inc., and Auto-Wares moved ahead of Strauss Discount, primarily through its Illinois acquisitions of Certified and Lee Auto Parts.

For a little historical perspective, consider this: In 2001, the 20 largest store groups accounted for 11,329 locations. Six years later, a significantly reshuffled top 20 list represents 14,340 stores — up 27 percent.

For the market at large, this growth (generally through acquisition) means that a higher percentage of the total number of stores in the market is controlled by a smaller number of companies. Counterman estimates that the total universe of parts stores in the U.S. (those that are primarily retail, wholesale and a mix of the two) number around 35,000 locations. That means that the industry’s 20 largest store groups now control 41 percent of the total universe of stores. That’s a lot of stores. That’s a lot of influence.

Retailers

Speaking of influence, AutoZone and Advance Auto Parts continue their positions as the top two store owners in the business, with more than a combined 6,841 stores. These two companies alone control 48 percent of all stores owned by this top 20 list.

AutoZone operates 3,812 stores (an increase of 200 over ’ 06), and continues to open new ones. In just the last quarter, AutoZone opened 40 new stores and replaced five. Its commercial division now accounts for 12 percent of all AutoZone sales. For the company, commercial sales remain a strategic priority, and with only a 1.3 percent market share, there’s plenty of room to grow. Other goals for the Memphis-based retailer: brand extensions for its Duralast and Valuecraft house brands, improved coverage and a program to “refresh” 700 stores in 2007.

Last year was a big one for Advance Auto Parts, as the company reached a number of significant milestones. The big news for Advance in 2006 was that it had reached $1 billion in commercial sales during a single fiscal year, excluding Autopart International stores. In addition, 2006 marked the company’s 75th anniversary, as well as the 10th anniversary of the launch of the company’s commercial sales program.Today, 81 percent of Advance’s 3,029 stores operate a commercial delivery program — a program that now represents 23 percent of Advance’s total sales.

Although more a hybrid than a strict retailer, O’Reilly Auto Parts last year projected the opening of 160 news stores. The company surpassed that estimate by 10. Overall, the company grew its total store count by an impressive 13 percent.

Among retailers, not all the news has been good. CSK has been embroiled in an ongoing accounting scandal, which forced out several key executives. Other retailers such as Pep Boys and Strauss Discount, too, have had a rough time with poor financial performance. Strauss Discount filed for bankruptcy protection in 2006, and remains the only store chain in bankruptcy on the ’07 Super Stores list.

Wholesalers

The usual suspects maintained their growth-through-acquisition strategies over the last year.

Uni-Select continued its acquisition pace, although on a much smaller scale. In 2006, the company acquired nine new businesses, most notably Alliance member Auto Craft Automotive Products and fellow Automotive Distribution Network member Tier Parts Warehouse. It is notable that Uni-Select grew its total store count by the greatest percentage, and now operates 28 percent more stores today than it did at this time last year.

Other notable growth came from Grand Rapids, MI-based distributor Auto-Wares, which acquired fellow Alliance member Certified Automotive warehouse and Lee Parts Stores, both located in the Chicago area. With the addition of Certified and Lee, Auto-Wares and its subsidiaries now have a major aftermarket presence in Michigan, Ohio, Indiana, Illinois and Wisconsin. In the last 12 months, Auto-Wares has increased its store count by 24 percent.

Growth was the driving force behind the decision to relocate for Automotive Parts Headquarters (APH), a distributor serving Minnesota, Wisconsin, North Dakota and Michigan. APH’s new corporate offices and distribution center now occupies a 160,000-square-foot building located in St. Cloud, MN. The facility provides 15,000 square-feet of office and training space and 145,000 square-feet of warehouse space. The new location replaces what had been six different warehouses spread throughout St. Cloud.

There is a good chance that 2007 will be another year of significant change within distribution. The ramifications of this change, driven largely by store and WD acquisition, will continue to have great impact on nearly every corner of the aftermarket, especially the program groups and suppliers that serve these store groups.

If current growth trends continue, by 2012 the industry’s top 20 store chains will own more than half of all the stores in the U.S. aftermarket. That’s a lot of stores — and a tremendous amount of influence.