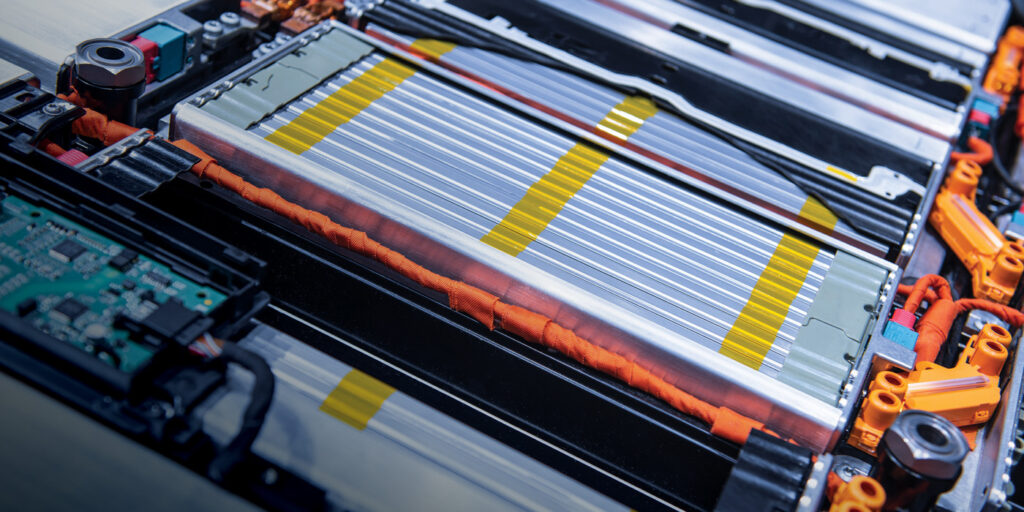

In the past, the lack of end-of-life batteries meant that the Li-ion (lithium-ion) recycling market had little opportunity to prosper. The transition to electric vehicles (EVs) is changing this, IDTechEx says in a recent report. Recycling enables countries to domesticate battery material supply, hedge risks of fluctuating metal prices, and reduce reliance on unsustainable mining practices. Various stakeholders across the value chain are upping recycling capacity to prepare for the mass availability of valuable end-of-life Li-ion batteries due to supply, regulatory and environmental motivations.

It seems that recovering valuable material by recycling Li-ion batteries is a no-brainer. However, the reality is more complicated, IDTechEx says. The profitability of recycling is dependent on EV-battery trends and whether OEMs will play a role in facilitating circularity in the battery supply chain.

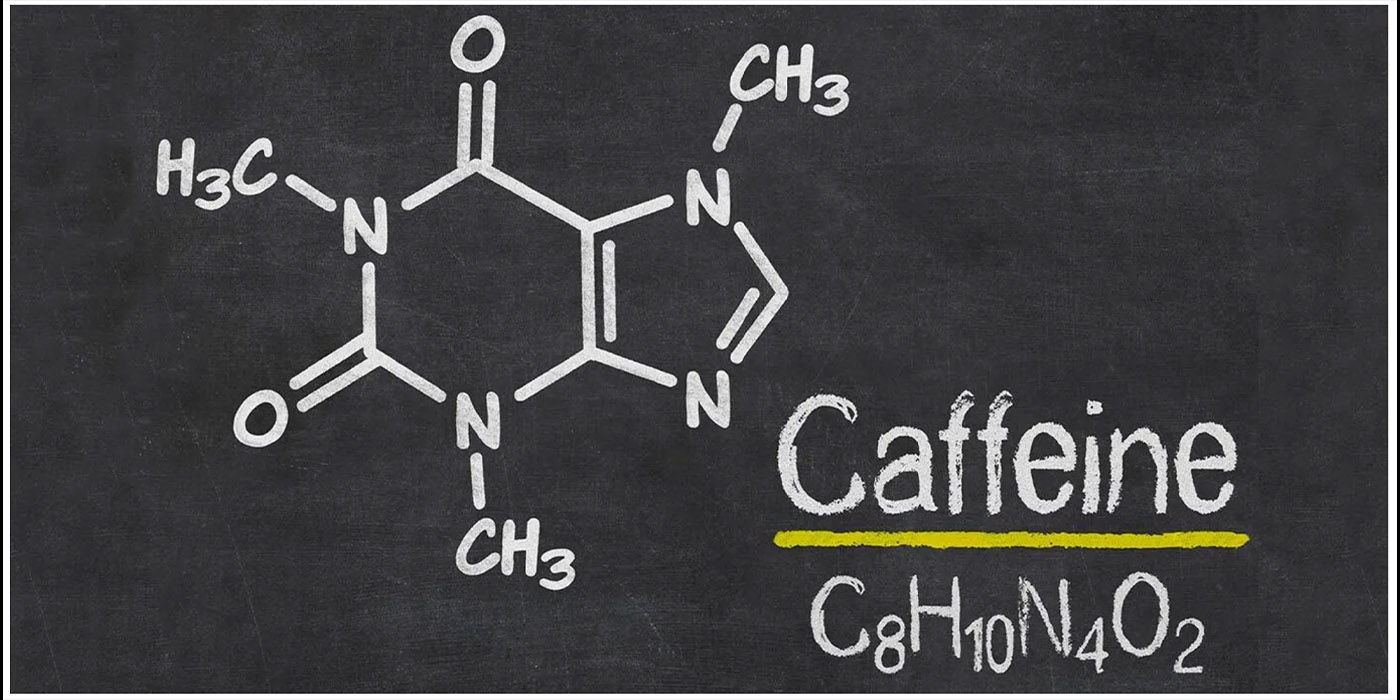

The economics of recycling primarily depends on three factors: Li-ion battery chemistry; metal prices; and process costs, which are expected to decrease as recyclers scale. There’s a lot of variety between the chemical composition of EV batteries, particularly in the cathodes. The demand for higher energy density in EV batteries is causing a shift toward higher-nickel cathodes. However, the desire to drive battery costs down favors lower-value LFP cathodes – which some OEMs have recently switched to for their entry-level models. This is likely to impact the value of metals that recyclers can extract from end-of-life

EV batteries.

The most value can be extracted from LCO cathodes due to their high cobalt content, but these are typically used in consumer electronics, which will account for a small percentage of Li-ion batteries recycled, and it’s challenging to develop collection networks for them. In the new IDTechEx report, “Li-ion Battery Recycling Market 2022-2042,” the recycling value of each cathode type is compared. IDTechEx has investigated these trends and their impact, alongside metal price, to evaluate the economics of the Li-ion battery

recycling market.

OEMs are often subject to Extended Producer Responsibility regulations, meaning they are responsible for EV batteries when they reach their end of life. Therefore, it’s in the OEMs’ best interests to develop efficient, economic routes for waste end-of-life batteries, and the environmental credentials associated with recycling also are beneficial.

Volkswagen is developing a vertically integrated recycling and second-life business through “Volkswagen Group Components” and commissioned a pilot plant for recycling Li-ion batteries in 2021. Differing from most EV OEMs, Renault operates a battery-hire scheme on three of its models, as well as full ownership options. Renault optimizes the end-of-life management of its EV batteries using second-life applications and recycling with partners, such as Veolia. Tesla claims to be developing a battery recycling system at its Gigafactory in Nevada, having relied on third-party recyclers in the past, and BMW has formed strategic partnerships with recyclers, seeking to design cells with recycling in mind, says IDTechEx.

Involvement of these major OEMs looking to boost the sustainability of their EVs reflects the anticipation of the part Li-ion battery recycling will play in the future value chain. Not only are the OEMs likely to carry a legal responsibility for end-of-life Li-ion batteries, but the trends they influence also will impact the profitability of recycling. In addition to creating partnerships with recyclers from other sectors, OEMs themselves are acting and investing in their own processes and supply circularity.

IDTechEx has identified nearly 90 battery recyclers globally and observed that most of the current recycling capacity is in China. In 2021, there was a deficit in the number of Li-ion batteries available for the recycling capacity, presenting a market imbalance. Timing growth with end-of-life battery availability will be one of the biggest challenges that recyclers will face, and battery manufacturing scrap is likely to facilitate an increase in capacity before EV batteries begin reaching their end of life.