Although range anxiety and the charging network remain reasons to hesitate, a recent global survey of consumers showed that potential EV buyers are most concerned about the impact to their wallet.

What’s more, this isn’t just a U.S.-market phenomenon. It’s affecting consumers worldwide – even in regions where EVs have made significant market inroads.

Globally, almost half (48%) of the 7,500 respondents to a recent S&P Global Mobility survey consider EV prices to be too high, even though they understand that most EVs inherently carry a price premium.

“Pricing is still very much the biggest barrier to electric vehicles,” explained Yanina Mills, senior technical research analyst at S&P Global Mobility.

Consumer sentiment toward buying an EV has cooled considerably over the last two years. This rise and fall are emblematic of an immature market segment, according to Mills. That said, improved electric-vehicle range, and the increased number of model choices, have moved down consumers’ list of reasons to avoid purchasing an EV.

Despite an increased number of EVs available – and improved consumer awareness of tax credits and benefits – fewer than half of respondents believe the EV technology is ready for mass-market adoption. Only 42% of respondents are considering an EV for their next vehicle purchase and 62% of respondents are waiting until the technology improves before purchasing a new vehicle, the S&P Global Mobility survey found.

How Things Have Changed

Initially, consumer interest was smothered by the limited variety of available EV models. Just 58% of 2019 S&P Global Mobility survey respondents were open to purchasing an EV, as luxury-priced models dominated the early EV market. Just a handful of mainstream models – like the Chevrolet Bolt, Nissan Leaf and Tesla Model 3 – were available at that time.

But 2021 saw a dramatic burst of consumer EV acceptance. Buyer willingness soared, with 86% of global respondents being open to acquire an EV. Multiple factors stirred up these good feelings: New mainstream models from Ford, Hyundai, Kia and Volkswagen hit the market. The pro-EV push in the United States by the Biden administration, and legislation in multiple U.S. states and in Europe banning future internal combustion engine (ICE) vehicles, further heightened visibility.

While 67% of the 8,000 participants surveyed in May 2023 were open to the idea of purchasing an EV – certainly higher than in 2019 – it’s a whopping 19 percentage point decline from 2021.

What happened? The last two years have brought more consumer choice. These span the far ends of the market, from hulking EV pickups in the United States to many small EV choices becoming available in Europe and China.

For one, price fatigue has set in, driven by rising interest rates and inventory shortages that have only recently seen relief, said Brian Rhodes, director of connected car and vehicle experience for S&P Global Mobility.

Depending on where an EV is manufactured, changes to the tax-credit program in the United States now force consumers to lease – rather than purchase – many models. Frequent media reports about charging-network reliability shortcomings haven’t helped either. At this point in the evolution of EVs, adding more models simply cannot cancel out these issues.

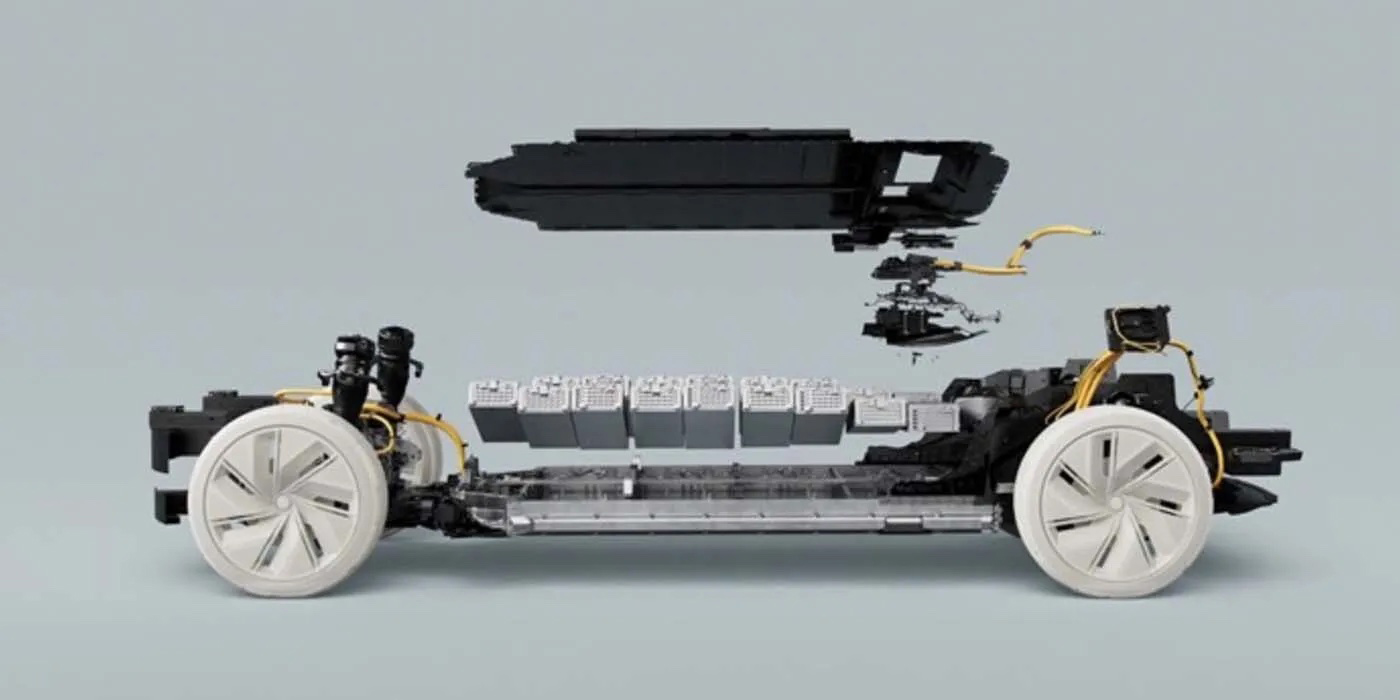

Owning an EV forces some changes in routine. Compared to an ICE vehicle, EV driving range is typically less. Once the battery charge is depleted, it takes longer to recharge a battery than it does to refuel a gas tank. Inherent EV drawbacks like these make consumers reluctant to buy, especially those regularly making long journeys. However, survey results show that consumers accept living with an EV’s concessions – relative to an ICE vehicle – post-purchase.

That said, many EVs purchased to date are second – often smaller – cars in the household. “For those considering an EV as their primary car, the range/charging issues are amplified since there is no alternative on longer trips,” Rhodes said.

Purchase Reasons Remain Consistent

Consumer willingness to buy an EV has waxed and waned over the last few years, but their reasons for purchase remain the same. The three main reasons to purchase an EV or hybrid are fuel savings (69%), environmental benefits (56%) and performance/driving experience (31%), according to the S&P Global Mobility survey.

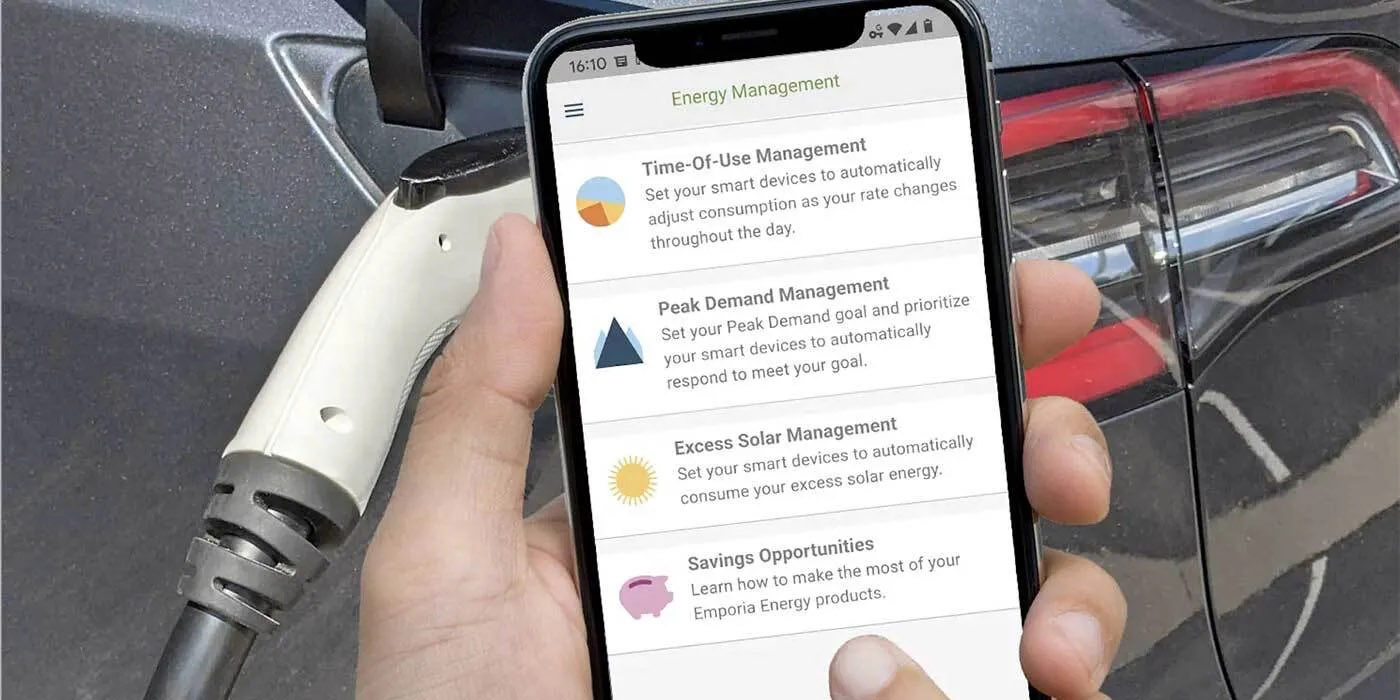

Electric-vehicle advocates, including the EPA, often tout downstream cost savings as a reason to purchase an EV. Many buyers indeed will save money on operating costs, but the equation is more complex. But buyers in coastal U.S. states – where the vast majority of EVs are purchased in that market – also suffer from high electricity costs, increasing the cost of operation for charging at home.

Meanwhile, while some free Level 2 chargers are available, charging at a fast DC charger is far from free. Among global respondents, those in the United States and Brazil were the most willing to pay for 10 minutes (60 miles of range) of fast charging, both at $19. For most ICE vehicles, this is more expensive than the gasoline needed to drive that distance.

A desire to reduce greenhouse emissions drives many consumers to purchase an EV. This goal also encourages the replacement of fossil-fuel-burning consumer goods – including heating/cooling systems and outdoor garden equipment – with their electric-powered equivalents. But all of this comes at a cost, both at purchase and for recharging.

“All-electric everything doesn’t seem to be achievable for a lot of consumers,” Mills said.

Multiple hurdles need to be cleared to achieve widespread EV adoption. Buyers may want to wait for the next technological advance, or have concerns about charging time and charger availability. However, in the end, consumer finances – not engineering – lead the current buying resistance to EVs.