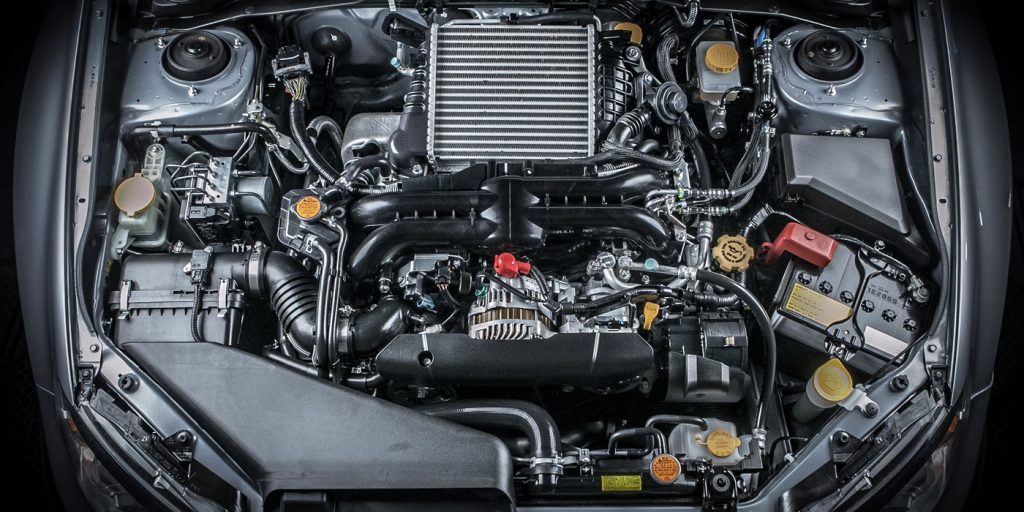

The number of cars and light trucks powered by internal combustion engines (ICE) will climb by 36 million between now and 2030 in the United States, despite predictions that electric vehicles will make them obsolete.

That’s according to a new report from Lang Marketing Resources.

“Cancel the obituary of the internal combustion vehicle,” said Jim Lang, president and lead author of the report. “They will grow in number in the U.S. throughout the decade.”

With ICE vehicles expected to maintain their dominant market share through 2030, demand for aftermarket parts and service should continue to be robust.

“Peak ICE – the year when internal combustion engine vehicles reach their maximum number – could arrive as late as 2035,” predicted Lang.

EV Sales Will Grow Too

While the number of ICE engines in the vehicle parc will continue to grow, the same is expected for electric vehicles.

Electric vehicles (battery-electric vehicles and plug-in electric hybrids) represented less than 2% of the 2019 new-vehicle market.

However, EV annual volume will increase fourfold by mid-decade, accounting for nearly 8% of 2025 light-vehicle sales, according to Lang Marketing Resources.

EV volume will reach 2.9 million units during 2030, double its 2025 share.

Despite the increasing EV sales, ICE cars and light trucks will continue to dominate the new-vehicle market. The resulting number of ICE vehicles in operation (VIO) will climb by 24 million during 2020 through 2025.

ICE vehicles in the United States will increase by another 12 million from 2026 to 2030, pushing their VIO growth to 36 million during 2020 through 2030, up from approximately 282 million vehicles in operation last year.

Regular hybrids and mild hybrids (both have batteries recharged by their combustion engines) are included as ICE vehicles in the Lang analysis, since most mileage of non-plug-in Hybrids is ICE-powered.

Peak ICE Year

The year of peak ICE in the United States (when ICE vehicles reach their maximum number) will be determined by two factors, according to Lang: the annual sales mix of ICE and EV vehicles, and ICE-vehicle scrappage.

Peak ICE will not be reached before 2032 and, under certain circumstances, it could arrive as late as 2035, Lang predicts.